Author: akinzer

-

The Pasadena Office Now Offers Diabetic Retinopathy Screening to Patients with Type I or Type II Diabetes

Diabetic Retinopathy is the most common diabetic eye disease and can lead to vision loss, but early detection may help reduce the severity of the disease. All people with diabetes, Type 1 or Type 2, are at risk for diabetic retinopathy. To identify problems, diabetics should have yearly eye exams/screenings as a part of your…

-

Flu Cases Are Rising: Protect Yourself This Season

Flu Cases Are Rising: Protect Yourself This Season Flu activity is increasing, making prevention more important than ever. How to Protect Yourself From the Flu The flu vaccine reduces your risk of getting the flu. It also reduces symptom severity and lowers the chance of serious complications. And it helps protect others from catching the…

-

Honoring a Legacy of Care: Celebrating the Retirements of Dr. Levine, Dr. Conger, and Dr. Jett

At Maryland Primary Care Physicians, long-term relationships are at the heart of everything we do. That includes the relationships our physicians build with patients, colleagues, and the communities they serve. As we recognize the retirements of Dr. Jerry Levine, Dr. Bruce Conger, and Dr. Patricia Jett, we want to pause and celebrate careers defined not…

-

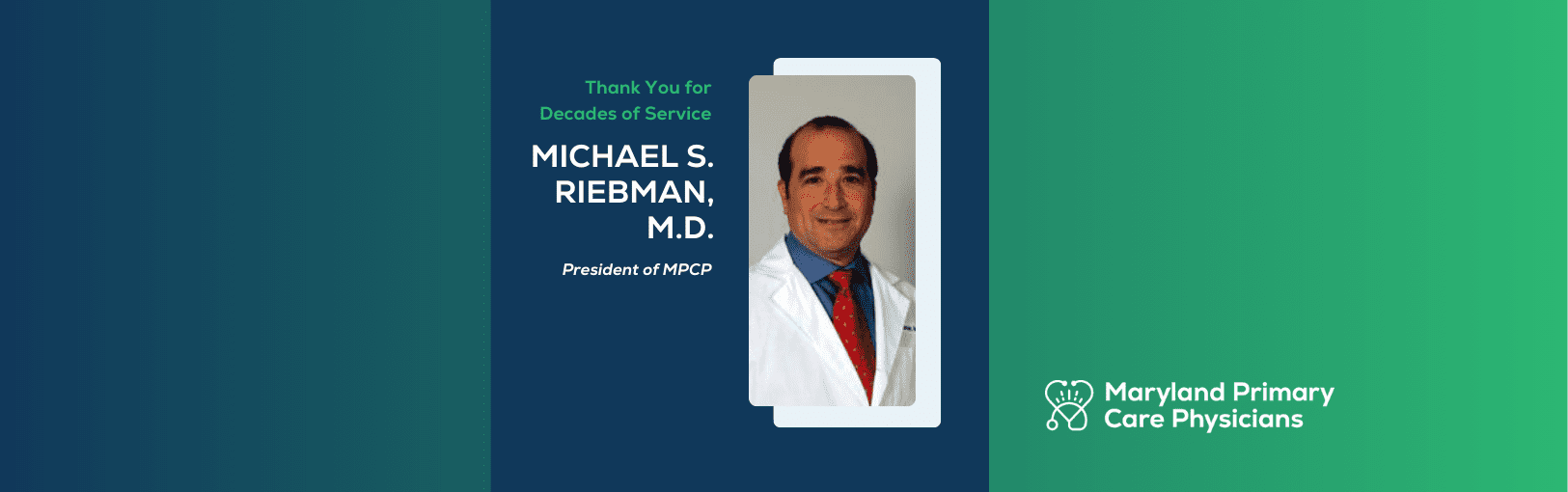

Dr. Michael Riebman, President of MPCP, Announces Retirement

Dr. Michael Riebman, President of MPCP, has announced his retirement from MPCP. After 45 years in medicine, Dr. Riebman plans to continue working full time through March 2026 and continue to work part time until his official retirement date of June 1, 2026. “It has been a pleasure and honor to work with Dr. Riebman…

-

MPCP Arnold and Pasadena Offices Recognized as Top 5 Medical Clinics of 2025

We’re proud to share that Maryland Primary Care Physician’s offices in Arnold and Pasadena were recognized among the top medical clinics of 2025 in their local communities by BusinessRate. This designation reflects outstanding patient reviews, strong satisfaction scores, and consistent service excellence compared with other local clinics, and is a testament to the compassionate, high‑quality…

-

Maryland Primary Care Physicians Launches Patient-Centered Brand Refresh Ahead of 30 Years Serving Maryland Families

FOR IMMEDIATE RELEASE Hanover, MD — December 1st, 2025 — Maryland Primary Care Physicians (MPCP), Maryland’s largest physician-owned primary care group, has unveiled a refreshed brand, logo, and website designed to reflect its continued commitment to patient-focused, accessible care for nearly 30 years. Serving more than 230,000 patients annually across 10 offices throughout Central Maryland…

-

Fraud Alert: Protecting Yourself from Healthcare Scams

It starts with a phone call, an unexpected email, or even a friendly knock at the door. Before you know it, someone’s after your money or worse, your health information. Scams have gotten bolder, sneakier and in some cases, dangerously personal. These scams can leave both your health, safety and finances in jeopardy. You can…

-

Don’t Shut Down, Stand Your Ground!!

By: ARIEL J. WARDEN-JARRETT, MD, FAAFP Have you ever felt that a provider did not listen to you or take your concerns seriously? Chances are, we have ALL felt that way at some point. But I have realized that communication gaps are often the roots of these frustrations. Allow me to explain. Through the years,…

-

Headlines, Hashtags, and Health: What to Trust (and What to Skip)

Smart choices start with smart sources. Here’s what to know. When it comes to your health, quality, credible information matters–and not all of it is information equal. Today, more people are turning to social media platforms like TikTok, Youtube, and even AI tools like ChatGPT to answer their health questions. While they can sometimes be…